Explore web search results related to this domain and discover relevant information.

“But are you short the market?” That is my favorite rejoinder to expressions of radical pessimism. It came to mind recently when I read an opinion piece suggesting that “the United States as we know it could come apart at the seams.” …Besides, shorting the market does not have to ...

“But are you short the market?” That is my favorite rejoinder to expressions of radical pessimism. It came to mind recently when I read an opinion piece suggesting that “the United States as we know it could come apart at the seams.” …Besides, shorting the market does not have to be impossibly risky.Another curious response I hear from pessimists is that they aren’t short the market because the death of democracy in the U.S., or the birth of fascism, isn’t going to be bad for the stock market. That is at least a consistent view — but it is wrong and oddly anti-democratic.…Besides, shorting the market does not have to be impossibly risky. Just buy some unleveraged market puts each year until that position pays off. That’s not a great investment tactic for most people, but it makes sense for diehard pessimists.

The Buckeye State’s tight inventory means fewer transactions are occurring, but properties are still getting multiple offers.

Market yield on U.S. treasury securities at 10-year constant maturity. Updated daily.Data sourced from FRED ... The Buckeye State’s tight inventory means fewer transactions are occurring, but properties are still getting multiple offersBut while the Buckeye State’s housing market is hot, with a HousingWire Data Market Action Index score of 49 as of April 11 — anything over 30 is considered a seller’s market — local professionals say the market is not as frenetic as it used to be.As of earlier this month the 90-day average number of single family listings hitting the market each week was 1,407, fractionally above the number of new listings for the same week over in the past four years. But the figure is still below the April 2019 number of 2,295 listings.But those clients or even parents of first-time buyers, who haven’t bought a home in 15 or 20 years, they think the prices are very high.” · With economic uncertainty rising, in part due to the Trump administration’s ever-changing tariff policies, some local Ohio real estate professionals are anticipating slower housing market conditions this summer and fall.

CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information.

U.S. MarketsIPO index hits 3-year high with Klarna latest offering set to boom. Can the hot market continue?3 Hours AgoThree major investment banks crank up their stock market forecasts4 Hours AgoJim Cramer's top 10 things to watch in the stock market Wednesday

(781) 786-2422 Facebook-f Instagram Youtube Tiktok The Market is Slow But… Click here to watch on Facebook. Read the blog below: Anthony: The market’s slow, […]

Anthony: The market’s slow, actually terribly slow. It slowed in an odd manner because not only there’s a substantial decrease in the amount of buyers, but it’s also in a situation where there’s a huge lack of sellers. Sellers are just not motivated to list.I’ll know, I’ll give you a better prediction in 60 to 90 days, but I think we’ll see sellers probably come out of the woodwork more after the first of the year, but really as we get into spring. That’s all folks. Listen, keep doing the fundamentals. Keep at the basics. Make sure you’re still getting in touch with people. Make sure you’re working on your database. Make sure you’re checking in with people. This is the time of year that you can– not the time of year. No, no. Well, it is as far as getting in touch with your sphere. This is one of those situations where you can grab more market share, you can get in touch with more people.Number one, historically speaking, one thing I’ve noticed after all these years of being in the business is the market doesn’t usually stay terribly slow, for more than about three or four weeks because it can’t, people have life needs, it only can hit a lull for so long.The Labor Day lull lasted a little bit longer than normal. Then it got busy for maybe 10 days, and now it’s just been lackluster since then. There’s a lack of pendings, lack of listings, buyers don’t have a ton of motivation. Some do, and there’s still some multiple offers, but not as many.

Does anyone try to time their monthly / weekly investments? For instance, I have a set amount of $ I'll invest each month. Instead of just lumping it…

Bogleheads are passive investors who follow Jack Bogle's simple but powerful message to diversify with low-cost index funds and let compounding grow wealth. Jack founded Vanguard and pioneered indexed mutual funds. His work has since inspired others to get the most out of their long-term investments. Active managers want your money - our advice: keep it! How? Investing in broad-market low-cost indexes, diversified between equities and fixed income.But only in regard to buying and only within a set month, so it's still high level DCA. I'm interested in seeing the performance difference just out of curiosity's sake... but the paying attention to the daily market part kinda defeats the point of not having to think about itThe psychological problem with the approach is that you might some months be tempted not to invest at all because of what you think the market's about to do. ... Exactly, it becomes a slippery slope. ... I could see that but it hasn’t happened (yet).But you are investing based on feels, not discipline. Each additional tweak you make in the direction of feels makes you more likely to make serious behavioral investing errors. And this system you have seems kind of complicated to me, which makes it easier to end up on a slippery slope. If you have an itch to play the market consider setting aside some amount of your portfolio <=5% (that you can afford to lose) to play with individual stocks, timing, or other long shots.

After months of gloomy news on the employment front, the latest BLS jobs report offers evidence that the job market is far from robust but not collapsing either, observes Gary Burtless. But the continued loss of jobs in the public sector is problematic—government job losses will offset some ...

After months of gloomy news on the employment front, the latest BLS jobs report offers evidence that the job market is far from robust but not collapsing either, observes Gary Burtless. But the continued loss of jobs in the public sector is problematic—government job losses will offset some or all of the payroll gains we see in the private sector.Financial markets will cheer the private sector payroll gains in the latest jobs report, but the overall picture of the job market offers little reason for optimism. The fraction of adults who hold jobs has now fallen below the worst month in the recent recession, and workers’ real earnings are flat.After months of gloomy news on the employment front, the latest BLS jobs report offers evidence that the job market, while far from robust, is not collapsing either. The most encouraging numbers in today’s employment report showed that private payrolls grew 154,000 in July.Since March, job losses in the household survey have averaged 142,000 a month. The unemployment rate edged down in July compared with June because the number of Americans looking for work declined. Many jobless adults are evidently (and justifiably) discouraged about their chances of finding a job in this market.

US stock futures (ES=F, NQ=F, YM=F) are rising Tuesday morning after a volatile few days that resulted in a significant loss in global equities. Yahoo Finance Markets Reporter Josh Schafer joins Morning Brief to discuss the market's mixed reaction to trade tensions with China, earnings season, ...

So I guess we probably in this market shouldn't overreact too much to where futures are versus sort of where we're headed, right? But I think what you're seeing right now in markets overall is perhaps just a little bit of calm, as you said, that there might be some negotiations on the table for some of these tariffs.Essentially, you've just seen the market sell off on broad growth fears and sort of what Goldman was getting at in their note talking about this being maybe a event-driven bear market that could happen. Remember, we're very close to bear market levels right now. But the fear of being a cyclical bear market, that would normally come with a recession and that would probably come with the widespread tariffs that we've talked about.That's not the kind of slowdown that we're talking about here. So that's how Goldman sort of gets to that cyclical bear market fear, not necessarily their call right now, but pointing out that's certainly a risk and something I think you've seen the market try to maybe price in over the last couple days.And that gives you a sense of where the market's at with a lot of these companies on a sector specific basis. For instance, if a company cuts its guidance, but the stock doesn't go down 10, 15% like it would in a normal quarter when people aren't expecting that, maybe you can sort of argue part of that is already priced in, right?

Earlier this week, our intern Jasmine sat down with one of our vendors to learn about our unique business structure. Berea Farmers Market is a cooperative, but what does that mean? This is what Jasmine found out... The Berea Farmers Market as cooperative means vendors working together and pitching

The Berea Farmers Market as cooperative means vendors working together and pitching in where they can. The Berea Farmers Market as a cooperative exhibits horizontal leadership rather than hierarchical. Vendors are focused on collaborating and cooperating in order to support each other as opposed to competing with one another.The way the cooperative is structured can serve as a model to some businesses because they are a member based organization where everyone has a sense of ownership when voting on important decisions. All of the people work together to make the Berea Farmers Market thrive and grow.Here are just a handful of our Berea Farmers Market cooperative members and board members from left to right; Amber Flindt (community board member), Tabea Wolf-Fourman (vendor and board president), Xyara Asplen (vendor), Laurie White (vendor and vice president board member), Susana Lein (vendor), Julie Dalton (community board member), Faye Adams-Eaton (manager), Lynne Gagliardi (vendor) and Jasmine McClain our wonderful volunteer!

Popular quantitative formulas have ... returns, but there is no one-size-fits-all investing solution. ... Don’t overstate the importance of the Fed—or even the impact of interest rates—when making investment decisions. ... Meltdowns follow melt-ups, and one could spring from Trump’s attacks on Fed independence, the veteran strategist says. Leslie P. Norton Sep 2, 2025 · The Fed’s next move, stretched valuations, a weakening dollar, and more for the market’s ...

Popular quantitative formulas have delivered strong returns, but there is no one-size-fits-all investing solution. ... Don’t overstate the importance of the Fed—or even the impact of interest rates—when making investment decisions. ... Meltdowns follow melt-ups, and one could spring from Trump’s attacks on Fed independence, the veteran strategist says. Leslie P. Norton Sep 2, 2025 · The Fed’s next move, stretched valuations, a weakening dollar, and more for the market’s outlook.The yellow metal has been on a tear, but caution may be warranted. Amy C. Arnott, CFA Sep 2, 2025 · Plus: Consumer stocks, a September rate cut, and August jobs data. ... This economist explains how superpower rivalry and geostrategic interests became the center of the global economy, and what history has to say about where we’re headed today. ... We wrap up our coverage of the markets and the week.Follow the market movements with our real-time trackers that show major indexes, global markets, sectors and more.We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

The Farmers Market at Forest Park, Springfield, Massachusetts. 5,447 likes · 968 were here. Winter Market Jan 6 & 20, Feb 3 & 17, Mar 2, 16 & 30, Apr 6 & 20 Free entry to market shoppers

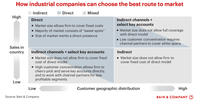

With field sales currently curtailed, determining the right route to market is essential for industrial companies.

What is the best route to market for an industrial company across its products and countries: going direct with its salesforce, or using dealers, importers or a hybrid of these? Many companies find it difficult to make an informed decision, because they lack the exact cost to serve through each channel, and they don’t know most customers’ channel preferences.One industrial equipment company that had seen its market share decline realized it needed a more coherent channel strategy for the 30 countries where it competed. In one small country, for instance, the fixed cost of a direct salesforce was no longer economically feasible.

Paris, le 25 septembre 2019 - A l’occasion du salon Paris Retail Week, BUT présente en avant-première sa plateforme marketplace basée sur la technologie de Mirakl qui sera mise en ligne courant octobre prochain. Avec plus de 50 000 produits et 60 marchands référencés au démarrage, ...

Paris, le 25 septembre 2019 - A l’occasion du salon Paris Retail Week, BUT présente en avant-première sa plateforme marketplace basée sur la technologie de Mirakl qui sera mise en ligne courant octobre prochain. Avec plus de 50 000 produits et 60 marchands référencés au démarrage, l’enseigne souhaite renforcer sa position sur le marché du e-commerce.La décision de BUT d’adopter le modèle de marketplace intervient sur un marché du meuble qui vit une véritable révolution digitale avec une part croissante des ventes totales du secteur en provenance de l’e-commerce.En étendant son offre à des familles de produits complémentaires comme des meubles de jardin, de la puériculture ou bien encore des produits de l’univers de la salle de bains… Avec sa marketplace pour meubles, BUT entend renforcer sa position d’expert de l’équipement de la maison et générer davantage de trafic vers l’enseigne.Avec nos 308 magasins physiques, notre site e-commerce et la marketplace, notre objectif est d’accroître l’offre proposée pour répondre au mieux aux besoins de nos clients et améliorer leur expérience d’achat, répondant ainsi aux géants du commerce en ligne avec une gamme de produits étendue tout en restant dans l'univers de BUT »,déclare Thierry Lernon, DG Clients, Data et E-commerce chez BUT.

BUT is the first home furnishing network. ... • 11% market share in the french furniture sector (2024) • 160 million visits per year of which 125 million online

BUT is also an omnichannel approach that has developed and accelerated over the last 5 years. The integration of new services, such as after-work delivery for customers in French cities, the improvement of the customer experience combined with the launch of our marketplace in 2019 and partnerships with major French digital players have enabled us to meet the new expectations of our customers.Sustainable growth is above all profitable growth. BUT is a large company that has a significant impact on its environment. We have also become leaders in certain markets and we have plans to continue our development by further improving our environmental impact.BUT is a popular French brand, today nº2 in the furniture market, which has managed to retain the agility of a fine SME thanks to a local management and strong entrepreneurial values - resilience, humility, transparency, independence - and a local presence throughout France.Alexandre Falck has been the Chief Executive Officer of BUT since October 2018. He began his career at Arthur Andersen, before joining Carrefour, where Alexandre Falck held various positions in financial and operational management, including Hypermarket Director and Regional Director in France and Asia. In 2009, Alexandre Falck took over the management of Carrefour Market in France.

This paper discusses two well-known market-based social change initiatives, Fair Trade coffee and Forest Stewardship Council certification, which harn…

A serious challenge for both is to operate in the conventional market without undermining their original objectives. A global commodity chain analysis approach is combined with insights from economic sociology embeddedness theory to explore the social, cultural and organizational factors shaping the initiatives’ governance structures. Both initiatives are seen to move along opposite organizational trajectories, but face similar pressures from conventional market logics, practices and dominant actors.Yet one of the most serious challenges of certification and labeling initiatives today is actually to be “in the market but not of it,” that is, to be able to pursue alternative values and objectives such as social justice and environmental sustainability without being captured by the market’s conventional logic, practices and dominant actors.A preliminary framework is proposed for comparative assessment, focusing on distribution of benefits, how conventional market institutions may be questioned, and how internal governance manages diverse stakeholder interests and influence.Certification and labeling initiatives worldwide gain growing attention as promising market-based instruments which harness globalization’s own mechanisms to address the very social injustice and environmental degradation globalization fosters.

Many of Donald Trump’s economic plans put forward during the presidential campaign seemed extremely unwise even to the corporate leaders who supported him and care about profits over everything else. Universal and large tariffs and mass deportations, for example, were clearly anti-growth ...

There are times when broad-based economic strength pushes up jobs, wages, and the stock market, and other times when broad-based weakness causes these all to fall together. But more often what is happening to stock prices gives us no insight into the wider economy.For the stock market as a whole, it is usually macroeconomic trends that cause increases or decreases in stock indexes. But just because it is macroeconomic trends that drive overall stock indexes, this does not mean they always move in the same direction—sometimes favorable macroeconomic trends can push up stock prices, but sometimes they can actually push stock prices down.But the profit share of income in the corporate sector is already starting from an extremely elevated level, making further increases likely harder to attain. Further, the effect on stock prices of any such redistribution will likely be overwhelmed by the broader downward pressures noted above. If a recession caused by the Trump policy agenda (as well as by any consumption cutbacks spurred by the falling stock market itself) is sharp enough, the Federal Reserve will cut interest rates.Given what we noted about the powerful effect of interest rate cuts on stock prices, this could halt the fall in stock prices and even provide some slight rebound. But by then the damage to the real economy— households’ jobs and wages—will have been done. In short, while the stock market isn’t the economy, the stock market declines we have seen in recent weeks are genuinely worrying.

Housing is a trillion dollar industry. How can tech, finance and cities work together to bring about a society we want to live in?

He sold his last startup to Trulia, so he’d been in the real estate market for a while. Honestly, it started with a very simple idea, which was, “Hey, when people actually buy and sell these things, they tend to use very little data.” If you’re a software engineer, you realize, “Oh, there’s data. In fact, there’s a lot of data. Can we put it into a software system that then actually gives you a dynamic price, one that you know you can make money on?” · But, where it really became real was when Eric realized, what if we actually offered it to customers?And I think the Bay Area tries to do the right thing, like inclusionary housing for example, but those solutions aren’t really scalable. Garry: We also need to build which we haven’t. The ADU law has been something that you’ve been tracking for a while and now that it’s here, it’s actually the most ripe way to get perhaps thousands of units per city. Kim: It’s millions, really. This is what suburban West Coast markets are comfortable with.A lot of the bills that we’ve tried to do around more mid-rise, or high-rise along transit corridors have been blocked, or stalled. But the laws around adding a unit in your backyard have just passed through every year. Consistently, this is what voters show that they want and so, this is what the broader housing market is going to deliver.Kim: Yeah, but many jurisdictions have this problem. I also think that, more broadly, people are living longer and a lot of the housing that we built throughout the United States is both car-centric and just very centered on this idea of the nuclear family. And it’s so obvious now that, as parents age, we want to live in multi-generational households. Or, as markets get expensive, if you want to live near extended family, for a lot of people it’s just not going to be possible to get into the house ladder in nearby markets at all.

Read more aboutMarket Commentary: Sentiment Shakey but Bull Market Still Intact from Carson Wealth. With Carson Wealth, money doesn't have to be complicated.

The Valentine’s Day Indicator suggests that any near-term weakness should be contained and the bull market is alive and well. Sentiment has been more muted than we expected based on recent surveys, although it’s still very early. There are also some signs that corporations are finding doing business more challenging under the new administration, but there are also areas where conditions are easing.Yes, things have been very good for investors and fortunately we’ve been in the camp for more than two years now that we are in a new bull market and that being invested in stocks made a lot of sense. But that doesn’t mean we don’t see some potential worries out there.Yes, we have many stocks doing well this year (even international and emerging markets are joining the party), but one worry we have is various A/D lines have yet to breakout to new highs. There is still time here, but we’d classify this as a yellow flag for the bulls right now.Over the last two years, markets have been able to tune out a pretty dour national mood. Even with all the negative sentiment, the S&P 500 gained more than 25% in both 2023 and 2024. In fact, real GDP growth clocked in at 2.9% annualized over the last two years, above the pre-pandemic trend. Sentiment was downbeat, but this didn’t really crimp consumer spending.

Sources say most staff working on the season-long market have left; the USDA disputes that claim.

July 8, 2025 – Last week, Secretary of Agriculture Brooke Rollins announced the U.S. Department of Agriculture (USDA) will host a week-long “Great American Farmers’ Market” on the National Mall, from Aug. 3 to Aug. 8. The event is tied to the Trump administration’s planned celebration of the 250th anniversary of the country’s founding. Expand your understanding of food systems as a Civil Eats member. Enjoy unlimited access to our groundbreaking reporting, engage with experts, and connect with a community of changemakers. ... But information on the event replaced a page on the USDA website that previously led to details on the agency’s season-long annual Friday farmers’ market, which typically runs outside its Washington, D.C., headquarters from May through October, with around 30 farms and food vendors represented each week.In March, the USDA’s Agricultural Marketing Service (AMS), which typically runs the Friday market, posted a call for vendors for the 2025 season on Instagram. But while a listing in its own directory says the market is open from May to October, it never opened.An agency spokesperson said the suggestion that staffing had anything to do with the discontinuation of the market is “incorrect,” but they did not answer detailed questions about whether the Friday market is officially cancelled, or whether farmers will face a gap in sales due to the closure.Nearly 100 AMS employees based in D.C. accepted a Trump administration resignation offer, which was intended to cut staff across the government, and according to two USDA employees who asked to remain anonymous due to the risk of retaliation, most of the staff working on the Friday market were among them.

The graphs below help appreciate the mismatch of sellers and buyers and the impact it can have on house prices. #markets

The following commentary is from Redfin “There are 34% more sellers in the market than buyers. At no other point in records dating back to 2013 have sellers outnumbered buyers this much. In other words, it’s a buyer’s market. Redfin expects home prices to drop 1% by the end of the year as a result.We have often discussed the outsized role that rent and implied rental prices, i.e., shelter prices, play in the Consumer Price Index (CPI) data. CPI may be much lower in the coming months when lagging CPI shelter prices catch up to market prices and fundamentals.Yesterday, we discussed how the recent push higher in the market is turning the weekly sell signals back toward buy signals, which is bullish for the markets. Furthermore, Michael touched on the statistics for selling in May. Focusing on the short term, the market started the month of June on a good note with a persistent rally yesterday.Historical data for the S&P 500 (since 1950) shows that June is typically a seasonally weak month—a key piece of the adage “Sell in May and go away.” That adage is a centuries-old market maxim rooted in the observation that stock market returns tend to be weaker during the summer months (May through October) compared to the “seasonally strong months” of November through April.

US stock futures were set to open sharply lower for the third straight day after massive routs that plunged stocks close to a bear market. But there was a silver lining – maybe.

US stocks are set for another miserable day. But… ... A pedestrian walk past the New York Stock Exchange. - Liao Pan/VCGPIX/AP · US stock futures were set to open sharply lower for the third straight day after massive routs that plunged stocks close to a bear market.Although those declines were sharp and significant, they were roughly halved from their low point Sunday night. The S&P 500 was at one point set to open in bear-market territory – a drop of 20% from a recent peak – after hitting a record high less than seven weeks ago, on February 19.Investors may be sensing a buying opportunity. With all the recent and rapid selling, stocks are getting cheap: They’re trading at a historically inexpensive 15 times future earnings projections. That could help markets rebound if investors believe stocks are oversold.That would be the second-fastest peak-to-bear market shift in history (the fastest occurred during the 2020 pandemic).